Effective from 01 March 2024

The rate of service tax in Malaysia (SST) is increased from 6% to 8%

What is SST ?

-

Service tax that is a tax charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business.

-

Sales Tax is single stage tax levied on imported and locally manufactured goods, either at the time of importation or at the time the goods are sold or otherwise disposed of by the manufacturer.

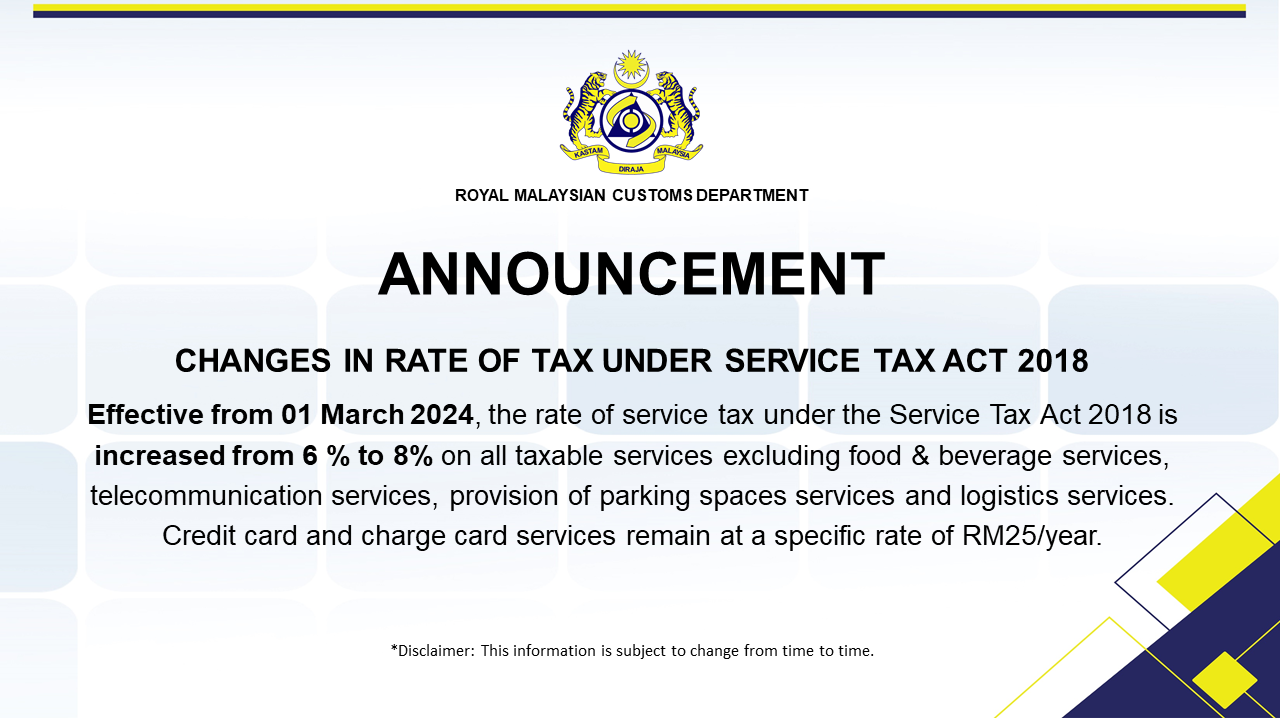

OFFICIAL ANNOUNCEMENT

According to Royal Malaysian Customs Department Effective from 01 March 2024, the rate of service tax under the service tax Act 2018 is increased from 6% to 8% on all taxable services excluding food & beverage services, telecommunication services, provision of parking spaces services and logistics services.

Buy Now and Save with ACAD Solutions

You still have time to save! Take advantage of our current prices and make your purchases before 1st March 2024 to avoid the upcoming tax hike. Whether it's that software you've been eyeing or training you wanted to have, now is the perfect opportunity to buy and save. Contact us and lock your price TODAY!

Why Choose ACAD Solutions Sdn Bhd as your best Local Reseller!

Yy choosing ACAD Solutions Sdn Bhd as your Local Reseller, you can save so much money without any additional charges or tax.

in the example given, you can save RM200 just by buying from ACAD Solutions instead of Online Principle, not to mention if you bought from Online Principle, you may risk paying additional increases in Tax imposed on payer if you late in payment.

Feeling lost? Get Free Consultation

AVOID ADDITIONAL CHARGES

According to LHDN Malaysia, online purchases from non-malaysian residents and Organizations will be charged an additional 10% Withholding Tax

Feeling all lost and confused?

Reach out to our team for free consultation!