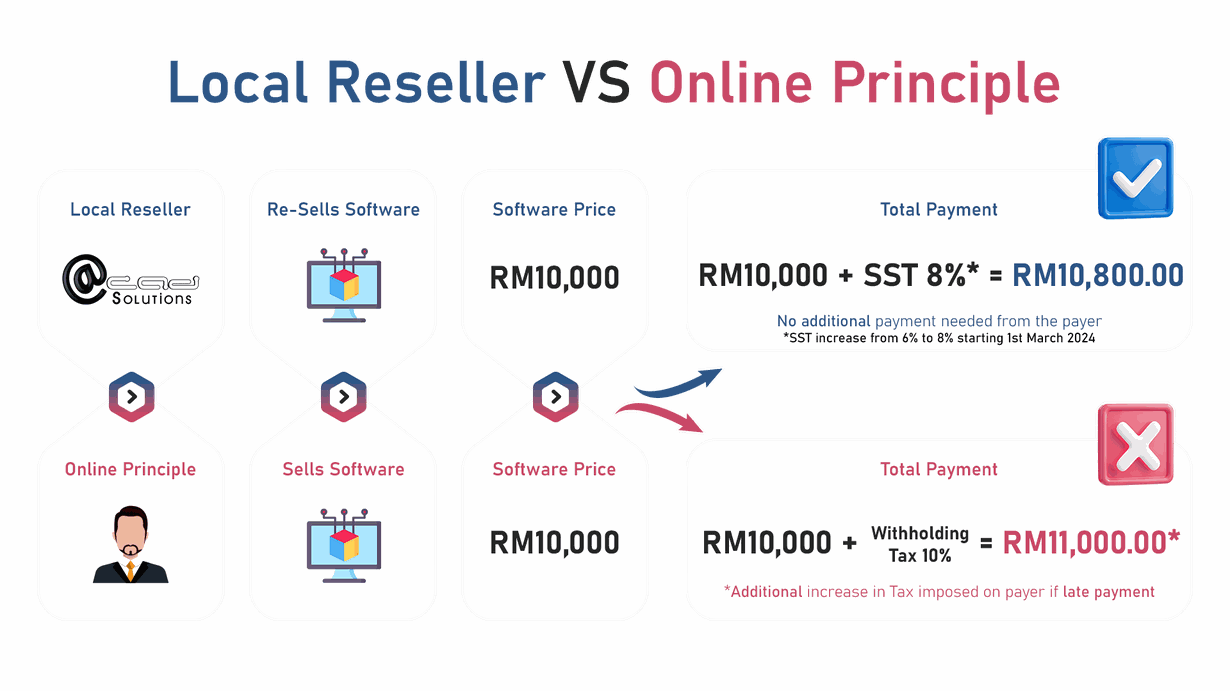

Be a Smart Consumer and Avoid Additional Charges .

According to LHDN Malaysia, online purchases from non-Malaysian residents and organizations will be charged with an additional 10% Withholding Tax .

With ACAD Solutions Sdn Bhd, you are in a trusted place.

What is Withholding Tax ?

Withholding tax is imposed on income that is paid to a non-resident individual.

The payer (the party making the payment) deducts taxes from the payee’s (non-resident individual) income. The withheld amount will be paid to the Inland Revenue Board (IRB) of Malaysia to calculate and pay all relevant taxes.

Withholding tax is essential because it helps to provide the government with a steady revenue stream, it also prevents from incurring double taxation.

‘Payee’ refers to a non-resident individual or any person other than an individual in Malaysia; this includes payments made by a foreign company that is remitted to a non-resident recipient and payments made by Malaysian companies or government agencies themselves to non-residents.

Why Choose ACAD Solutions Sdn Bhd as your best Local Reseller!

By choosing ACAD Solutions Sdn Bhd as your Local Reseller, you can save so much money without any additional charges or tax.

in the example given, you can save RM200 just by buying from ACAD Solutions instead of Online Principle, not to mention if you bought from Online Principle, you may risk paying additional increases in Tax imposed on payer if you late in payment.

Feeling lost? Get Free Consultation

Withholding Tax Deduction (Details)

The Income Tax Act, 1967 provides that where a person (referred herein as "payer") is liable to make payment as listed below (other than income of non-resident public entertainers) to a non-resident person ( NR payee), he shall deduct withholding tax at the prescribed rate from such payment and (whether such tax has been deducted or not) pay that tax to the Director General of Inland Revenue within one month after such payment has been paid or credited to the NR payee. Check the Table

All withholding tax payments (other than for non-resident public entertainers) must be made with the relevant payment forms, duly completed, together with copy of invoices issued by the NR payee and copy of payment documents as proof of date of payment /crediting to the NR payee.

Please ensure that the forms are completed accurately furnishing the Malaysian tax reference number for the payer, payee as well as the payee's country of origin.

If the payer does not have the reference number of the payee, the payer may request for such number from :

Director

Federal Territory of Kuala Lumpur

Customer Services Unit

3rd Floor Left, Block 8

Government Office Complex Jalan Duta

50600 Kuala Lumpur

Stating the full name, address of the payee and the nature of payment.

For urgent payment (where the income tax reference number of the payee is not known), the payer may send the Forms CP 37A/ CP 37/ CP 37D together with the payment, copy of invoice and remittance slip (telegraphic transfer) directly to:

Director

Federal Territory of Kuala Lumpur

Withholding Tax Unit

7th Floor Right, Block 8

Government Office Complex Jalan Duta

50600 Kuala Lumpur

Guidelines

Enforcement for Compliance

(Other than for withholding tax on non-resident public entertainers and resident individuals)

The following constitutes non-compliance:

-

The payer fails to pay withholding tax at the prescribed rate (whether deducted or not).

-

The payer pays withholding tax late (not within the period of one month after Date of payment / crediting to the NR payee).

-

The payer fails to pay increase in tax imposed on him for late payment of withholding tax or for failure to pay withholding tax.

Enforcement

Where the payer fails to pay or pays withholding withholding tax late (not within the period of one month after the date of payment / crediting to the NR payee), he is imposed an increase in tax of a sum equal to ten percent of the amount which he fails to pay is imposed.

Example :

-

Royalty paid to NR payee on 03/08/2006 = RM200,000

-

Withholding tax received by IRBM on 10/09/2006 later than 02/09/2006) = RM20,000

-

Increase in tax imposed on payer (20,000 @ 10 %) = RM2,000

-

Effective from 02/09/2006.

Where the payer fails to pay withholding tax and / or increase in tax imposed on him:

No deduction is given for the payment made to a NR payee against business income in the income tax computation of the payer, and Civil suit action on the payer to recover withholding tax and / or increase in tax not paid which remains a debt due to the Government.

Contract payments made to non-resident contractors in respect of services under a contract are subject to withholding tax of:

-

10 % on the service portion of the contract payments on account of tax payable by the NR payee;

-

3 % on the service portion of the contract payments on account of tax payable by employees of the NR payee;

"Services under a contract" means any work or professional services performed or rendered in Malaysia in connection with or in relation to any undertaking, project or scheme carried on in Malaysia; and

The payer must, within one month after the date of payment / crediting the contract payment, remit the withholding tax (whether deducted or not) to the Inland Revenue Board, Malaysia. See "Withholding Tax Deduction".

Interest paid to a NR payee is subject to withholding tax at 15% (or any other rate as prescribed under the Double Taxation Agreement between Malaysia and the country where the NR payee is tax resident). This is a final tax.

Interest is deemed derived from Malaysia if:

-

Responsibility for payment lies with the Government or a State Government;

-

Responsibility for payment lies with a resident of Malaysia;

-

Interest is charged as an outgoing or expense against any income accruing in or derived from Malaysia.

Interest not subject to withholding tax:

-

Interest paid to a NR payee on an approved loan

-

Interest paid to a NR payee by a licensed bank or licensed finance company in Malaysia other than:

-

Such interest accruing to a place of business in Malaysia of the NR payee

-

Interest on funds required for maintaining net working funds prescribed by Bank Negara.

The payer must, within one month after the date of payment / crediting the interest, remit the withholding tax (whether deducted or not) to the Inland Revenue Board, Malaysia.

Royalty is defined as

Any sums paid as consideration for the use of or the right to use:

-

Copyrights, artistic or scientific works, patents, designs or models, plans, secret processes or formulae, trademarks or tapes for radio or television broadcasting, motion picture films, films or video tapes or other means of reproduction where such films or tapes have been or are to be used or reproduced in Malaysia or other like property or rights.

-

Know-how or information concerning technical, industrial, commercial or scientific knowledge, experience or skill.

-

Income derived from the alienation of any property, know-how or information mentioned in above paragraph of this definition.

The gross amount of royalty paid to a NR payee is subject to withholding tax at 10% (or any other rate as prescribed under the Double Taxation Agreement between Malaysia and the country where the NR payee is tax resident). This is a final tax.

Royalty deemed derived from Malaysia if:

-

Responsibility for payment lies with the Government or a State Government;

-

Responsibility for payment lies with a resident of Malaysia;

-

The royalty is charged as an outgoing or expense against any income accruing in or derived from Malaysia.

The payer must, within one month after the date of payment / crediting the royalty, remit the withholding tax (whether deducted or not) to the Inland Revenue Board, Malaysia. See "Withholding Tax Deduction".

Special classes of income include:

-

payments for services rendered by the NR payee or his employee in connection with the use of property or rights belonging to or the installation or operation of any plant, machinery or apparatus purchased from the NR payee.

-

payments for technical advice, assistance or services rendered in connection with technical management or administration of any scientific, industrial or commercial undertaking, venture, project or scheme or

-

rents or other payments (made under any agreement or arrangement) for the use of any moveable property.

Provided that in respect of paragraph (a) and (b), this section shall apply to the amount attributable to services which are performed in Malaysia.

Payment is deemed derived from Malaysia if:

-

Responsibility for payment lies with the Government or a State Government.

-

Responsibility for payment lies with a resident of Malaysia.

-

Payment is charged as an outgoing or expense in the accounts of a business carried on in Malaysia.

The gross amount of "Special Classes of Income" paid for the above services rendered by a NR payee is subject to withholding tax at 10% (or any other rate as prescribed in the Double Taxation Agreement between Malaysia and the country in which the NR payee is tax resident). This is a final tax.

The payer must, within one month after the date of payment / crediting of the payment to the NR payee, remit the withholding tax (whether deducted or not) to the Inland Revenue Board Malaysia . See "Withholding Tax Deduction"

"Public Entertainer" means a stage, radio or television artiste, a musician, athlete or an individual exercising any profession, vocation or employment of a similar nature.

Remuneration or other income in respect of services performed or rendered in Malaysia by a Non-resident public entertainer is subject to withholding tax at 15 % on the gross payment.

The present practice continues whereby the sponsor of the non-resident public entertainer is required to pay withholding tax at 15 % before an entry permit for the non-resident public entertainer can be obtained from the Immigration Department.

Malaysia has concluded about 74 effective Double Taxation Agreements (DTA). For information on the varying rates of withholding tax on interest, royalty and technical fees, see "DTA Agreement Rates".

For refund of withholding tax overpaid by the payer due to the DTA reduced rates, the payee must forward the application for refund to the Director, Non Resident Branch together with the following details:

-

Tax resident certificate of the payee from the tax authority of the country where the payee is resident.

-

Evidence to prove that the conditions stipulated in the DTA are met.

-

Proof of payment of withholding tax.

Withholding Tax Table

|

Payment Type

|

Income Tax Act 1967

|

Withholding Tax Rate |

Payment Form

|

|

Contract Payment

|

Section 107A (1) (a) & 107A (1) (b)

|

10%, 3%

|

CP 37A

|

| Interest |

Section 109

|

15% |

CP 37

|

| Royalti |

Section 109

|

10% | CP 37 |

|

Special classes of income: Technical fees, payment for services, rent/payment for use of moveable property

|

Section 109B

|

10% | CP 37D |

|

Interest (except exampt interest) paid by approved financial institutions

|

Section 109C

|

5% | CP 37C |

|

Income of non-resident public entertainers

|

Section 109A

|

15% |

Payment memo issued by Assessment Branch

|

|

Real Estate Investment Trust (REIT)

|

Section 109D

|

10% |

CP 37E

|

|

Family Fund/Takaful Family Fund/Dana Am (i) Individual and other (ii) Non Resident Company |

Section 109E

|

8% 25% |

|

|

Income under Section 4(f) ITA 1967

|

Section 109F

|

10% |

CP 37F

|

Feeling all lost and confused?

Reach us out for our free consultation!