What is a Withholding Tax?

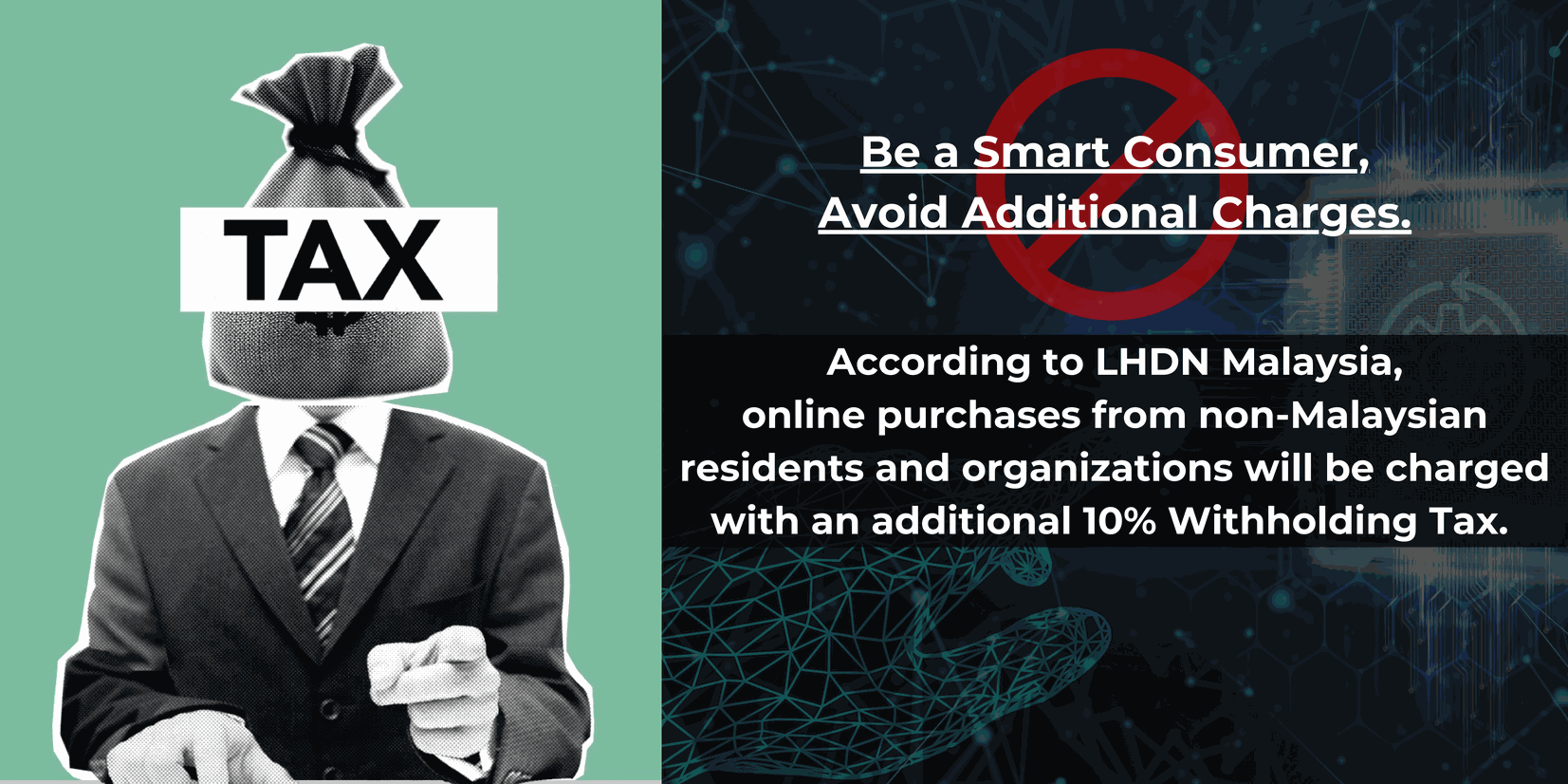

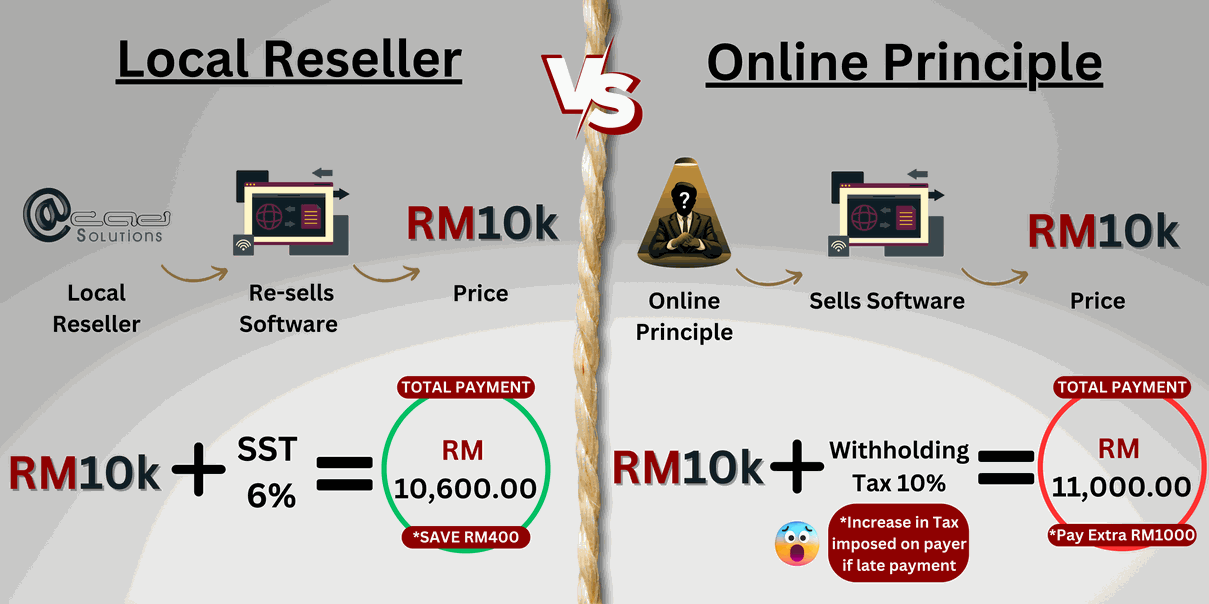

Withholding tax is an amount withheld by the party making payment (payer) on income earned by a non-resident (payee) and paid to the Inland Revenue Board of Malaysia.

'Payer' refers to an individual/body other than individual carrying on a business in Malaysia. He is required to withhold tax on payments for services rendered/technical advice/rental or other payments made under any agreement for the use of any moveable property and paid to a non-resident payee.

'Payee' refers to a non-resident individual/body other than individual in Malaysia who receives the above payments.

Withholding Tax Deduction (Details)

The Income Tax Act, 1967 provides that where a person (referred herein as "payer") is liable to make payment as listed below (other than income of non-resident public entertainers) to a non-resident person (NR payee), he shall deduct withholding tax at the prescribed rate from such payment and (whether such tax has been deducted or not) pay that tax to the Director General of Inland Revenue within one month after such payment has been paid or credited to the NR payee.

All withholding tax payments (other than for non-resident public entertainers) must be made with the relevant payment forms, duly completed, together with copy of invoices issued by the NR payee and copy of payment documents as proof of date of payment /crediting to the NR payee.

Type Of Income Subject To Withholding Tax And Withholding Tax Rate On Non-Resident Persons:

Withholding Tax On Non-Resident Persons :

Please ensure that the forms are completed accurately furnishing the Malaysian tax reference number for the payer, payee as well as the payee's country of origin.

If the payer does not have the reference number of the payee, the payer may request for such

number from :

Director

Non Resident Branch

Customer Services Unit

3rd Floor Left, Block 8

Government Office Complex

Jalan Duta, 50600 Kuala Lumpur

Stating the full name, address of the payee and the nature of payment.

For urgent payment (where the income tax reference number of the payee is not known), the payer may send the Forms CP 37A/ CP 37/ CP 37D together with the payment, copy of invoice and remittance slip (telegraphic transfer) directly to:

Director

Non Resident Branch

Withholding Tax Unit

7th Floor, Block 8

Government Office Complex

|

Payment Type

|

Income Tax Act 1967

|

Withholding Tax Rate |

Payment Form

|

|

Contract Payment

|

Section 107A (1) (a) & 107A (1) (b)

|

10%, 3%

|

CP 37A

|

| Interest |

Section 109

|

15% |

CP 37

|

| Royalti |

Section 109

|

10% | CP 37 |

|

Special classes of income: Technical fees, payment for services, rent/payment for use of moveable property

|

Section 109B

|

10% | CP 37D |

|

Interest (except exampt interest) paid by approved financial institutions

|

Section 109C

|

5% | CP 37C |

|

Income of non-resident public entertainers

|

Section 109A

|

15% |

Payment memo issued by Assessment Branch

|

|

Real Estate Investment Trust (REIT) (i) Other than a resident company (ii) Non Resident company. (iii) Foreign investment institution effective from 01/01/2007 |

Section 109D

|

10% 24% 10% |

CP 37E

|

|

Family Fund/Takaful Family Fund/Dana Am (i) Individual and other (ii) Non Resident Company |

Section 109E

|

8% 25% |

|

|

Income under Section 4(f) ITA 1967

|

Section 109F

|

10% |

CP 37F

|